Study: Sparrows Point Terminal to add US$1.54 b annually to Maryland economy

NewsThe economic impact study forecasts that the Sparrows Point Container Terminal will contribute US$1.54 billion annually to Maryland’s economy.

The disruption on US supply chains after Baltimore bridge collapse is expected to reverberate through key sectors such as wood, construction machinery, steel, aluminum, and automobile manufacturing.

In the wake of the devastating Baltimore bridge collapse, concerns are mounting over the impending impact on crucial supply chains across various industries in the United States.

The collision, which occurred when the Singapore-flagged containership Dali struck the Francis Scott Key Bridge, has far-reaching ramifications, particularly in the realm of containerized freight to bulk shipments.

The Francis Scott Key Bridge is the outermost bridge in the approach to the Port of Baltimore and the most important terminals, including SeaGirt Container Terminal, Dundalk Terminal and the ro-ro/car terminal are upstream of it.

The collapse has blocked the main access to the port of Baltimore and trapped six bulk carriers and two navy vessels. These have included bulk carriers such as JY River, Klara Oldendorff, and Phatra Naree.

According to Ernie Thrasher, chief executive officer of Xcoal Energy & Resources LLC, cited by Bloomberg, the collapse of the Baltimore is likely to shut down the port’s coal exports for as many as six weeks and block the transport of up to 2.5 million tons of coal.

Industry majors such as Maersk and MSC have already announced that they would omit calls at Baltimore as all vessel traffic to and from the port remains suspended.

“Although it is still very early, we already anticipate that all scheduled inbound container vessels will not be able to call the container terminals in the Port of Baltimore and as a result will need to divert to alternate Ports instead. Likely alternates would be those in Norfolk, New York/New Jersey, Savannah and Charleston. Any containers already waiting for export from the Port of Baltimore will need to either wait for the eventual re-opening of the waterway, or be gated out of the terminals and transported to one of these alternate ports. It is too soon to know to what degree, however this will inevitably have an impact on the cargo flows and infrastructure on the USEC,” Mike DeAngelis, Senior Director, International Solutions at FourKites, a supply chain intelligence platform, said.

“The tragic collapse of the Francis Scott Key Bridge is going to put pressure on other modes and port alternatives, as we will likely see diversions to other ports. Even once they remove the rubble from the water, traffic in the area will be impacted as truck drivers become reluctant to take loads in and out of the region without a price increase,” Jason Eversole, VP, Professional Services Solutions at FourKites, added.

The disruption is expected to reverberate through key sectors such as wood, construction machinery, steel, aluminum, and automobile manufacturing, significantly affecting production and distribution channels nationwide.

“The bridge collapse is the latest challenge for northeast US supply chains, including access to the Red Sea and Panama Canal as well as the prospect of port strikes later in mid-2024. Both bridge reconstruction and cargo delays are likely to be extensive. However, some freight across containerized and bulk modes could reroute to nearby ports in Wilmington, Delaware and Philadelphia, Pennsylvania,” Chris Rogers, Head of Supply Chain Research, S&P Global Market Intelligence, said.

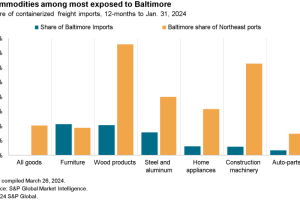

“The port handled around 3% of all US east and gulf coast imports and 10% of US northeast imports of containerized freight in the 12 months to Jan. 31, 2024. It is particularly important for the wood (39% of northeast ports’ imports), construction machinery (31%) and steel/aluminum (20%) sectors. Consumer goods exposures including home appliances (16%) and furniture (9%).

“The port is also one of the largest handlers of specialty wheeled transport shipments (cars and trucks) in the US, though one of the major terminals is located oceanside from the bridge and so may face less disruption.”

Disruptions to 10% of northeast imports: Supply chain impact

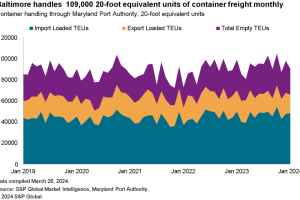

The Port of Baltimore handled 650,897 TEUs of inbound traffic and 272,8590 TEUs of outbound shipments in the 12 months to Jan. 31, 2024, accounting for 2.8% and 3.1% of the US east and Gulf Coast total, respectively, according to S&P Global Market Intelligence data.

Container freight accounted for 75% of volumes handled through the port in the past 12 months, with autos and roll-on, roll-off capacity representing another 18%, while bulk shipments of steel and forestry products accounted for much of the remainder.

The port is also one of the largest handlers of specialty wheeled transport shipments (cars and trucks) in the US, though one of the major terminals is located oceanside from the bridge and so may face less disruption.

By subscribing you will have: