Carriers optimistic for the peak season

NewsCarriers plan to blank 3.9% of Asia-North America West Coast capacity, aligning with pre-pandemic averages, indicating confidence in the 2024 peak season.

The demand for transporting empty containers has surged much more than the demand for transporting full ones, with back-haul trades expanding 2½ times faster.

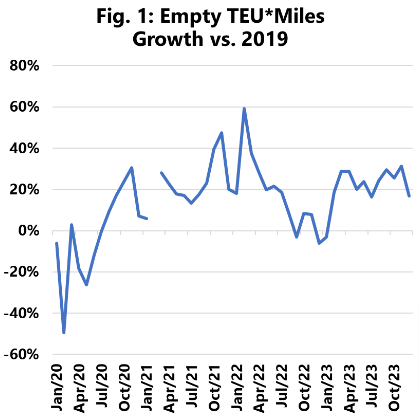

By analysing data sourced from Container Trade Statistics (CTS) on the movement of full containers between regions, it is evident that the expansion of empty container volumes, when compared to 2019 (excluding the significant fluctuations caused by the pandemic), has hovered around the 20% threshold over recent months.

Sea‐Intelligence, a leading provider of research and analysis, data services, and advisory services within the global supply chain industry, has published an article that sheds light on the influence of expanding trade imbalances on the logistical efforts required for empty container repositioning.

When examining volume solely in TEU terms, can provide a reasonable indication of market dynamics. However, considering that operational expenses associated with empty movements are primarily tied to port handling costs, an argument can be made that TEU*Miles serves as a superior metric.

This is because it provides a more accurate measure, particularly for full containers, as the distance travelled plays a crucial role in assessing container demand. Neglecting to evaluate empties similarly may lead to inconsistencies in analysis.

In essence, there is no distinction in development when assessing empty movements by TEU*Miles as opposed to measuring in TEU alone.

The crucial consideration is how this aligns with the expansion in loaded containers. Worldwide TEUs experienced a 2.5% increase compared to 2019, while TEU*Miles saw a growth of 4.2%.

Specifically focusing on head-haul trades, TEU growth stood at 7.8% in December 2023 compared to 2019, with TEU*Miles growth slightly higher at 8.0%.

The demand for transporting empty containers has surged much more than the demand for transporting full containers, with back-haul trades expanding 2½ times faster.

Consequently, the expenses associated with moving head-haul containers have increased, implying that head-haul shippers will need to bear the rising burden of covering the costs of moving empty containers in the future.

Global liner performance hits lowest point since September 2022