CMA CGM to acquire 48% stake in Santos Brasil

NewsCMA CGM has signed an agreement to acquire a 48% stake in Santos Brasil, a multi-terminal operator managing key assets across Brazil’s ports.

In the throes of the Red Sea crisis, schedule reliability of global liner majors is resuming a downward trend.

Global liner schedule reliability continues to decrease in the face of the ongoing Red Sea crisis, as shown in the latest Global Liner Performance (GLP) report by Sea-Intelligence maritime analytics firm.

The report covers 34 different trade lanes and 60+ carriers, revealing concerning trends in the global shipping landscape.

The latest findings indicate that there was -5.1 percentage point month-on-month (M/M) drop in January 2024, mirroring the decline observed in December 2023. The overall schedule reliability score for January 2024 stands at 51.6%, marking the lowest since September 2022.

Comparing year-on-year (Y/Y) figures, January 2024’s schedule reliability was -0.8 percentage points lower than January 2023. Specifically, as a response to the increasing number of attacks by the Houthi forces in the Red Sea, liner companies are redirecting their services around the Cape of Good Hope out of security concerns. Hence, the impact of round-of-Africa sailings contributed to a deterioration in the average delay for late vessel arrivals, increasing by 0.59 days M/M to 6.01 days.

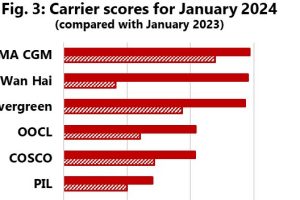

Despite the challenging conditions, some carriers managed to maintain a degree of reliability. CMA CGM emerged as the most reliable top-13 carrier in January 2024, boasting a schedule reliability of 54.7%. Four other carriers surpassed the 50% mark, while the remaining carriers fell within the 40%-50% schedule reliability range. Yang Ming ranked as the least reliable carrier with a schedule reliability of 42.2%.

Notably, the difference in schedule reliability between the most and least reliable carriers in January 2024 was the narrowest since February 2023, as explained by Alan Murphy, CEO, Sea-Intelligence. The Red Sea crisis, coupled with significant delays in round-of-Africa sailings, contributed to a scenario where none of the top-13 carriers recorded a M/M improvement in schedule reliability. Only seven carriers managed a Y/Y improvement in January 2024, the report said.