IBIA and BIMCO partner on fuel and maritime challenges

NewsIBIA and BIMCO partner to address bunkering challenges, foster clean energy solutions, and advance sustainable shipping practices.

The impact of elections in India, Mexico, the European Parliament, and the United States, could introduce further uncertainty to supply chain risks in 2025.

The Baltic and International Maritime Council (BIMCO) hosted a webinar titled “Container Market Dynamics: Beyond The Red Sea Crisis.”

This webinar, which took place on Tuesday, gave a thorough overview of the current trends, challenges, and opportunities in the container shipping industry.

The speakers included Niels Rasmussen, Chief Shipping Analyst at BIMCO; Chris To, Managing Editor of Global Container Markets at S&P Global Commodity Insights; and Mohammed Al-Ansare, Associate Editor at S&P Global Commodity Insights.

During the first part of the webinar, the latest data was presented, focusing on the impacts of the Red Sea crisis.

This crisis has prompted rapid adaptations among industry players, resulting in operational adjustments and route optimizations to minimize disruptions and ensure smooth business operations.

Consequently, by January 2024, these adaptations peaked, with newbuilds offsetting trade disruptions and idle capacity dropping to 0.9% by late March, compared to 3.2% during the same period last year.

Container spot rates have been fluctuating due to disruptions in the Red Sea market. However, carrier schedule reliability is showing signs of stabilization.

Moreover, there are looming geopolitical uncertainties affecting global trade patterns. While global trade measures indicate a slowdown in trade facilitation, there’s anticipation surrounding the impact of upcoming elections in India, Mexico, the European Parliament, and the United States, which could introduce further uncertainty to supply chain risks in 2025.

Furthermore, there’s a notable shift away from China in various US supply chains, with goods being redirected to Mexico and ASEAN countries. This trend of reshoring away from China is likely to accelerate in 2025.

Despite increased Red Sea transits, manufacturers seem relatively unaffected. However, the impact of the Baltimore Bridge collapse remains uncertain, although it’s unlikely to result in chaos.

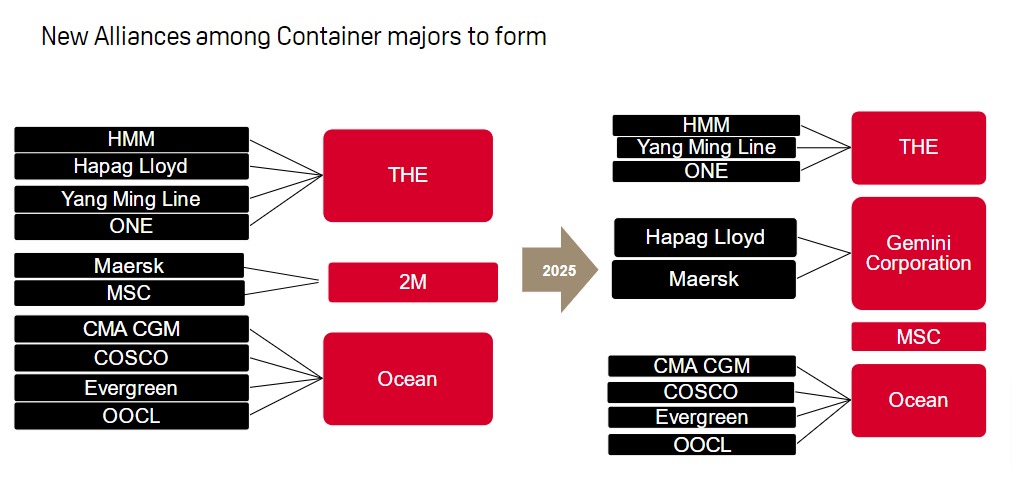

Gemini Corporation has proposed a hub-and-spoke model to enhance operational efficiency and optimize container flows. This model aims to streamline logistics operations, improve connectivity between key hubs, and enhance overall supply chain performance.

To address delays caused by the Red Sea crisis, shipping companies are growing their supply faster than their fleets, resulting in a 3-4% increase in sailing speed in Q1 of 2024, expected to normalize in 2025.

Commenting on the costs of the EU ETS Surcharge, Chris To emphasized the lack of clarity and transparency from several carriers regarding these costs.

By subscribing you will have: