Maersk keen on investing in Pakistan

NewsDanish Ambassador H.E Jakob Linulf and APM Terminals CEO Keith Svendsen met Pakistani officials to discuss port investments and logistics collaboration.

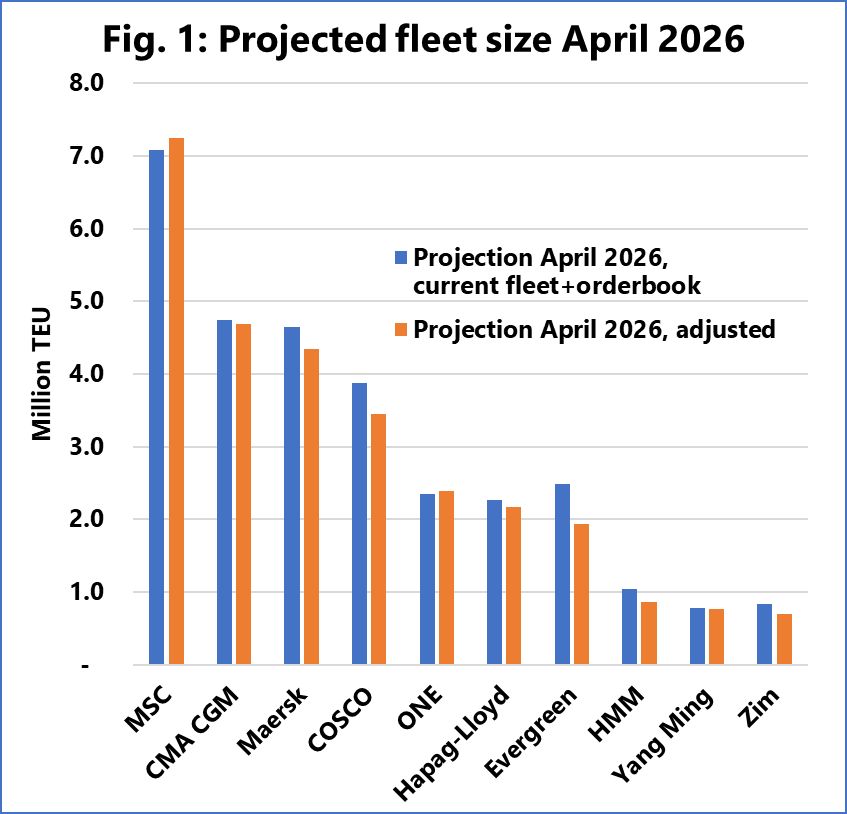

MSC is poised to increase size gap over CMA CGM, and Maersk will become the second-largest carrier; Hapag-Lloyd aims to maintain top-5 status.

MSC will grow their size advantage substantially compared to CMA CGM – which will become the second-largest carrier, relegating Maersk to third, Sea-Intelligence predicts.

“Another thing to note is that Hapag-Lloyd has recently issued its new 2030 strategy and one of its priorities is to remain a top-5 carrier. This will require a change in approach compared to the last 2 years, otherwise, Hapag-Lloyd will be pushed to a ranking of sixth, behind ONE,” Sea-Intelligence explains.

“The figure below shows the projected fleet sizes in April 2026, if we employ the simplistic or adjusted approach (i.e., also account for current tonnage strategies), which assumes that the strategic approach followed in the last two years will also apply in the coming two years,” Sea-Intelligence continues.

According to Sea-Intelligence, when forecasting the future fleet sizes of shipping lines, it is quite common to see an approach where the current fleet size is simply added to the size of the orderbook. Whilst convenient, this approach is rather one-dimensional, as shipping lines can also trade in the second-hand market, as well as increase or decrease their use of chartered vessels.

“A more comprehensive method is to look at the fleet adjustment strategy of individual shipping lines in recent years and use this perspective to project their anticipated fleet size into the future. This is under the assumption that each carrier maintains the same approach to their second-hand tonnage strategy, as well as their own vs. charter strategy,” Sea-Intelligence further explains.

“If we were to use the more simplistic approach to predict the current fleet sizes, based on the actual fleet and orderbook from two years ago, for 8 of the 10 largest carriers, the actualised fleet growth turns out to be less than what the simplistic projection would suggest,” Sea-Intelligence concludes. “This implies that the delivery of newbuilds typically leads most carriers to also shed capacity, by selling owned tonnage in the second-hand market or redelivering charter tonnage. Only MSC and ONE deviate from this, by also taking in additional tonnage.”

By subscribing you will have: